In recent years, Vietnam furniture export has experienced remarkable growth, establishing the country as one of the top players in the global furniture market. With a record high of $17.5 billion in 2024, Vietnam is now the 2nd largest furniture exporter worldwide, following only China. This growth underscores Vietnam*s competitiveness in the global trade landscape, fueled by its skilled workforce, competitive labor costs, and increasing focus on quality standards.

This article explores the Vietnam furniture export data for 2024每25, identifies the leading Vietnam furniture exporters, examines the top destinations by country, and provides a long-term perspective on how the industry is shaping global trade.

Growth of Vietnam Furniture Export Industry

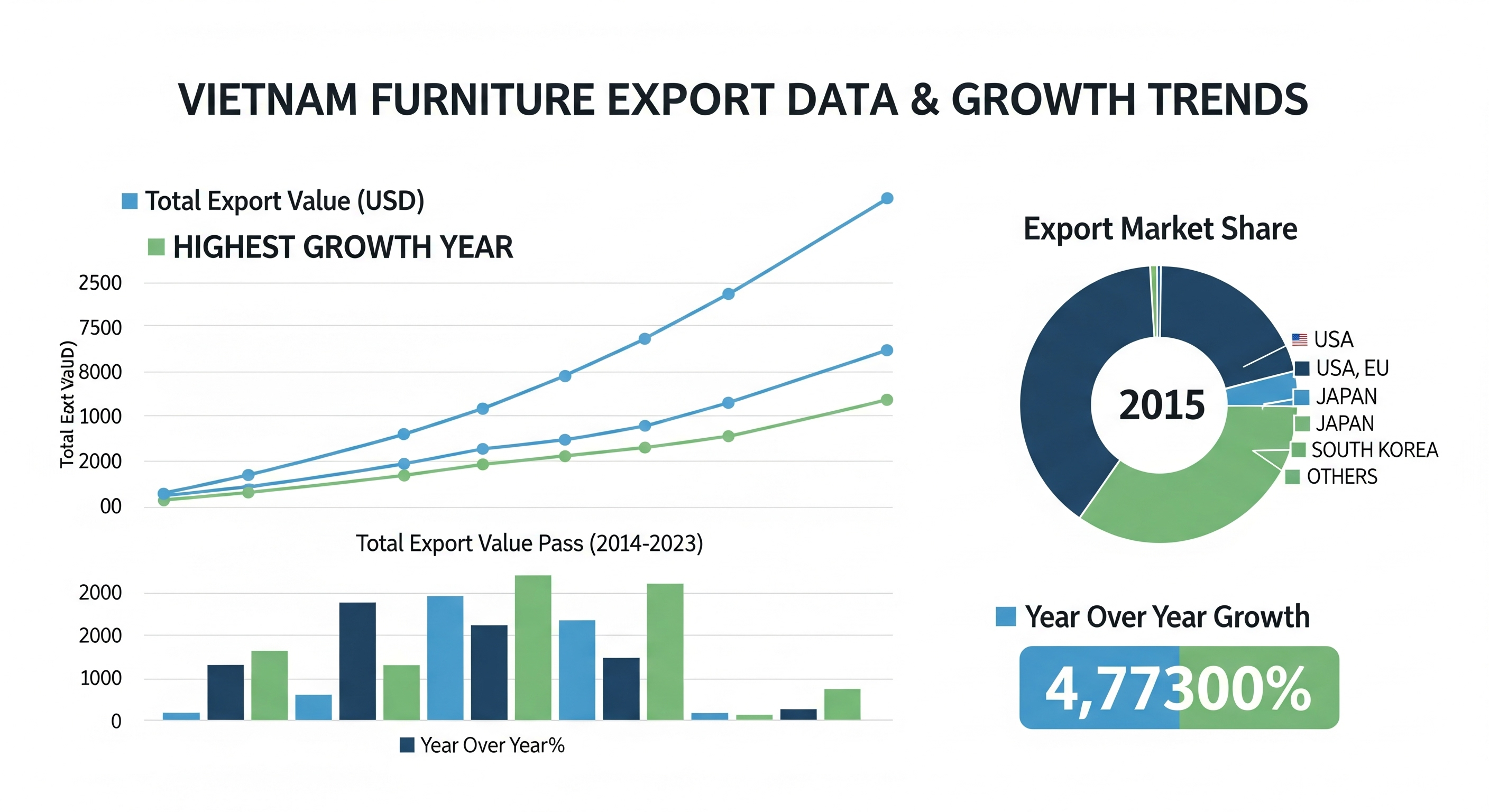

The Vietnam furniture export sector has become one of the most dynamic industries in Asia. Over the past decade, exports have surged from just $3.43 billion in 2014 to $17.5 billion in 2024. This represents a fivefold increase, a testament to Vietnam*s ability to scale production and capture global demand.

In 2024, exports from wood and wood products reached $16.25 billion, with non-timber forest products such as bamboo and rattan contributing an additional $1.05 billion. Wooden furniture alone generated $3.1 billion, highlighting international demand for sustainable and high-quality Vietnamese products.

The industry*s resilience is even more impressive given global economic challenges. Despite inflationary pressures, supply chain disruptions, and stricter import standards, Vietnam*s furniture industry has not only survived but thrived.

Vietnam Furniture Export by Country

According to Vietnam import customs data, furniture exports are widely diversified across global markets, though the United States remains the largest buyer. Below are the top destinations for Vietnam furniture export in 2024-25:

United States 每 $9.01 billion (56%)

The U.S. remains Vietnam*s dominant market, accounting for more than half of total exports. American consumers value the craftsmanship, affordability, and durability of Vietnamese-made furniture.

Japan 每 $287.62 million (4.5%)

Japanese buyers prefer Vietnam*s eco-friendly and elegant designs, making it a consistent growth market.

United Kingdom 每 $164.91 million (2.6%)

The UK market is steadily expanding, with demand for stylish, modern Vietnamese furniture.

Canada 每 $150.14 million (2.3%)

Canadian imports focus heavily on sustainable products, boosting demand for Vietnam*s eco-certified furniture.

South Korea 每 $105.53 million (1.6%)

Korean consumers appreciate Vietnam*s functional and versatile designs.

Australia 每 $94.22 million (1.5%)

Australia favors durability and outdoor furniture, creating strong opportunities for growth.

France 每 $92.78 million (1.4%)

French buyers are drawn to timeless and elegant furniture from Vietnam.

Germany 每 $63.44 million (1%)

Known for its strict quality standards, Germany values Vietnam*s adherence to international benchmarks.

Netherlands 每 $48.88 million (0.8%)

Dutch buyers prefer Vietnam*s sustainable, eco-friendly designs.

China 每 $44.06 million (0.7%)

Surprisingly, even China, a global furniture hub, imports affordable Vietnamese furniture.

These figures from Vietnam import customs data clearly show the global appeal of Vietnam*s products, with strong penetration into both developed and emerging markets.

Top Vietnam Furniture Exporters

The success of Vietnam furniture export is powered by leading companies that dominate production and distribution. According to trade databases, here are some of the top Vietnam furniture exporters by revenue in 2024:

Kaiser Group 每 $3.6 billion

Specializes in bedroom, dining, and upholstered furniture. The U.S. is its largest market.

Inni Home 每 $600 million

Known for dining sets, chairs, and accent furniture.

Rochdale Spears Ltd 每 $400 million

Produces high-quality kitchen, office, and bedroom furniture.

KEESON Co. Ltd 每 $355 million

Focused on smart furniture like adjustable beds and sofas.

Savimex Corp 每 $350 million

Vertically integrated manufacturer with strong exports to the U.S., EU, and Japan.

Phu Tai JSC 每 $300 million

Produces both indoor and outdoor wooden furniture.

190 Furniture JSC 每 $250 million

Specializes in office and school furniture.

AA Corporation 每 $200 million

Supplies custom luxury and hotel furniture.

These major Vietnam furniture manufacturer exporters drive innovation and maintain Vietnam*s global edge. Smaller firms are also entering niche markets, expanding product categories like eco-friendly furniture and modular designs.

Long-Term Export Trends (2014每2025)

Vietnam*s export trajectory shows consistent long-term growth:

2014: $3.43 billion

2018: $4.60 billion

2020: $6.94 billion

2022: $8.09 billion

2024: $17.50 billion

The sharp jump in 2024 reflects strong recovery post-pandemic, improved logistics, and the U.S. market*s robust appetite for imports. In Q1 2025 alone, exports were valued at $3.93 billion, a 11.6% year-on-year increase.

Opportunities & Challenges

Opportunities:

Rising demand from the U.S. and Japan.

Sustainable and eco-friendly furniture is gaining global traction.

Vietnam*s competitive pricing strengthens its market share.

New markets in Europe, South America, and Southeast Asia are opening.

Challenges:

Heavy reliance on the U.S. market (56%) creates vulnerability.

Stricter international regulations like EU CBAM and timber legality checks increase compliance costs.

Branding and original design are still limited, with most exports focusing on cost advantage.

Trade friction and fluctuating logistics costs can impact profits.

To maintain momentum, Vietnam furniture exporters need to diversify markets, invest in green certifications (FSC, PEFC), and focus on branding for premium segments.

The Outlook for 2025 and Beyond

The future of Vietnam furniture export looks promising. With continued investment in design, sustainability, and supply chain optimization, Vietnam can further consolidate its position as a global furniture leader. By 2030, the country may rival China as the world*s largest furniture exporter.

For businesses and buyers, monitoring Vietnam import customs data and updated trade statistics will remain crucial to understanding market shifts and sourcing opportunities.

Conclusion

The Vietnam furniture export sector is booming, cementing Vietnam*s position as a global powerhouse in the industry. Backed by leading Vietnam furniture manufacturers and exporters, diversified markets, and a strong production base, the country is well on its way to becoming the top global furniture supplier.

To achieve long-term success, however, Vietnam must reduce its reliance on the U.S., adapt to stricter international standards, and invest in sustainable innovation. If these steps are taken, Vietnam*s furniture industry is poised for even greater achievements in 2025 and beyond.